Payroll Audit and Social Security Numbers - March 2005

|

Payroll Audit and Social Security Numbers

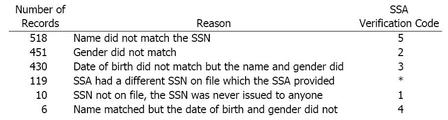

Released: March 2005 Download the Full Report here As part of the payroll audit, our office submitted a list of present and past city employees to the Social Security Administration (SSA) for name and SSN verification. A total of 24,784 records were submitted. The SSA found that 1,534 city records (1,505 individuals) did not match their records. |

Of these individuals, we identified 518 as listing names that did not match their social security numbers and 119 who had listed different social security numbers than the ones assigned to them by the SSA.

We recommended that the city contact all current employees who had the above verification errors, request that they complete IRS form W-9 (or a substitute as long as it is substantially similar to form W-9), and submit this information to the IRS. The city can be subject to a $50 penalty for each incorrect SSN submitted to the IRS. We also recommended that the city take extra steps to verify the social security numbers of all new hires.

We recommended that the city contact all current employees who had the above verification errors, request that they complete IRS form W-9 (or a substitute as long as it is substantially similar to form W-9), and submit this information to the IRS. The city can be subject to a $50 penalty for each incorrect SSN submitted to the IRS. We also recommended that the city take extra steps to verify the social security numbers of all new hires.